By Grace Alegba

Bureau De Change Operators (BDCs) on Monday appealed to the Central Bank of Nigeria (CBN) to further extend the recapitalisation deadline and review license requirements to save jobs.

The BDCs, under the aegis of the Association of Bureau De Change Operators of Nigeria (ABCON), made the appeal in an interview with the News Agency of Nigeria (NAN) in Lagos.

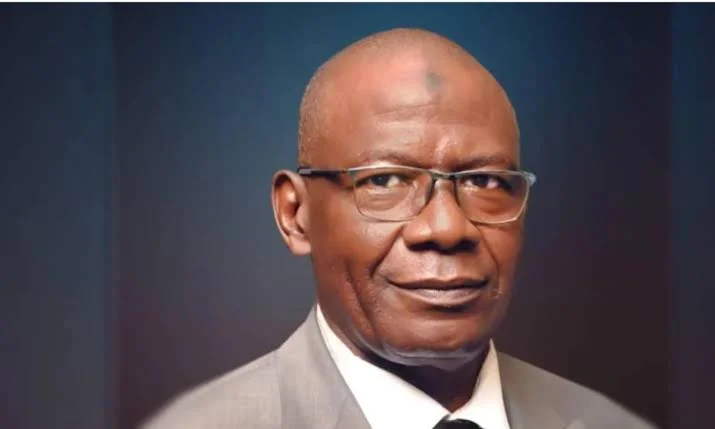

ABCON President, Dr Aminu Gwadabe, told NAN that a further extension and review would give more members opportunities to meet the new capital threshold.

NAN reports that the CBN in May 2024 issued new operational guidelines for BDCs, which became effective on June 3, 2024, directing all existing BDCs to reapply for new licenses.

BDCs with Tier 1 licenses were expected to have a capital base of N2 billion, while Tier 2 licenses needed N500 million, with non-refundable license fees of N5 million and N2 million respectively.

Both Tier 1 and Tier 2 BDCs were given six months to meet the minimum capital requirement of the license category applied for.

However, the apex bank later extended the recapitalisation deadline by an additional six months, which will lapse on Tuesday, June 3.

With the new deadline in sight, Gwadabe expressed fears of mass job losses, noting that less than 10 per cent of his members had complied with the new capital threshold.

He estimated that over three million jobs and livelihoods were at risk.

“The way forward to mitigate this is an appeal for further extension and a deliberate review of the financial requirements as some members strive to achieve them.

“The CBN should continue their stakeholder collaboration during the time of the extension to douse the anxiety, pressures, and tension currently enveloping the sector.

“Finally, there is the acceleration of the licensing process to give hope, clarity, and direction to the investors who have met the requirements and the prospective investors,” he said.

He explained measures by the association to curb job losses, including continued engagements with the Central Bank of Nigeria and lobbying of other relevant agencies.

He added that there were ongoing strategic sessions among ABCON members towards identifying frameworks like mergers, investor acquisition, and seeking a “No Objection” from the CBN.

The ABCON boss added that this was to allow members to establish public limited liability companies across clusters for more participation and inclusiveness.

“The plans for mergers include identifying like minds in five, 10, 15, 20 entities to come together and float a new entity.

“As earlier mentioned, we have also applied to the CBN for ‘No Objection’ on our plans to float public limited liability with capacity to absorb many of our members but met a holding response from the CBN,” he said. (NAN)(www.nannews.ng)

Edited by Olawunmi Ashafa