By Okeoghene Akubuike

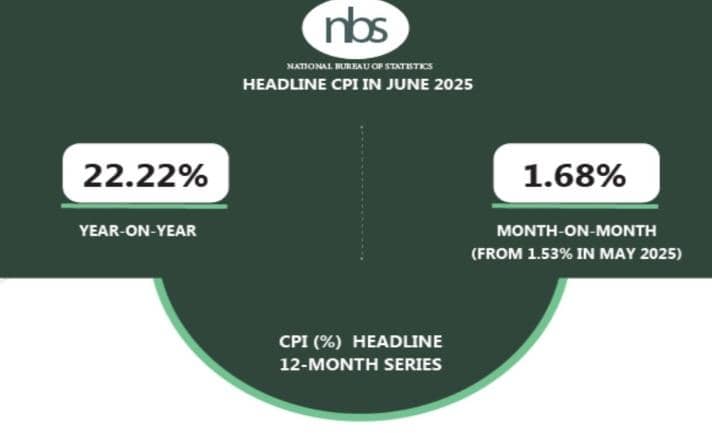

The National Bureau of Statistics (NBS) says Nigeria’s headline inflation rate eased further to 22.22 per cent in June 2025.

The NBS disclosed this in its Consumer Price Index (CPI) and Inflation Report for June 2025, which was released in Abuja on Wednesday.

According to the report, the headline inflation showed a decrease of 0.76 per cent compared to the 22.97 per cent recorded in May 2025.

Furthermore, the report said ‘on a month-on-month’, the headline inflation rate in June 2025 was 1.68 per cent, which was 0.15 per cent higher than the rate recorded in May 2025 at 1.53 per cent.

“This means that in June 2025, the rate of increase in the average price level was higher than the rate of increase in the average price level in May 2025.”

The report said the increase in the headline index for May 2025 was attributed to the increase in some items in the basket of goods and services at the divisional level.

It said the three major contributors to the headline inflation on a year-on-year basis were Food and non-alcoholic Beverages at 8.89 per cent, Restaurants and Accommodation Services at 2.87 per cent, and Transport at 2.37per cent.

The report showed the least contributors were Recreation, Sport, and Culture at 0.07 per cent, Alcoholic Beverages, Tobacco, and Narcotics at 0.08 per cent, and Insurance and Financial Services at 0.10 per cent.

The report said the food inflation rate in June 2025 was 21.97 per cent on a year-on-year basis, which was 18.90 per cent points lower compared to the rate recorded in June 2024 at 40.87 per cent.

“The significant decline in the annual food inflation figure is technically due to the change in the base year.”

It said on a month-on-month basis, the food inflation rate in June was 3.25 per cent, which increased by 1.07 per cent compared to the 2.19 per cent recorded in May 2025.

The NBS said the increase in food inflation was attributed to the reduction in average prices of items such as of Green Peas (Dried), Pepper (Fresh), Shrimps (white dried), Crayfish, Meat (Fresh), Tomatoes (Fresh), Plantain Flour, Ground Pepper, etc.

The report said that “all items less farm produce and energy’’ or core inflation, which excludes the prices of volatile agricultural produce and energy, stood at 22.76 per cent in June 2025, on a year-on-year basis.

“On a month-on-month basis, the Core Inflation rate was 2.46 per cent in June, which increased by 1.36 per cent compared to the 1.10 per cent recorded in May 2025.”

The NBS said for the newly introduced sub-indices, on a month-on-month basis, Farm Produce and Goods stood at -13.3 per cent and 0.93 per cent compared to May 2025, which were 22.38 per cent and 9.39 per cent, respectively.

“Conversely, Services and Energy stood at 3.26 per cent and -11.0 per cent compared to 1.79 per cent and -0.43 per cent recorded in May, respectively.

The report said that on a year-on-year basis in June 2025, the urban inflation rate was 22.72 per cent.

“On a month-on-month basis, the urban inflation rate was 2.11 per cent in June 2025, which increased by 0.71 per cent compared to May at 1.40 per cent.”

The report said in June, the rural inflation rate was 20.85 per cent on a year-on-year basis.

“On a month-on-month basis, the rural inflation rate was 0.63 per cent in June, which decreased by 1.2 per cent compared to May at 1.83 per cent.”

On states’ profile analysis, the report showed that in June, all items index inflation rate on a year-on-year basis was highest in Borno at 31.63 per cent, followed by Abuja at 26.79 per cent and Benue at 25.91 per cent.

It said the slowest rise in headline inflation on a year-on-year basis was recorded in Zamfara at 9.90 per cent, followed by Yobe at 13.51 per cent, and Sokoto at 15.78 per cent.

The report, however, said in June 2025, the inflation rate on a month-on-month basis was highest in Ekiti at 5.39 per cent, followed by Delta at 5.15 per cent, and Lagos at 5.13 per cent.

“Zamfara -6.89 per cent, followed by Niger at -5.53 per cent and Plateau at -4.01 per cent recorded the slowest rise in month-on-month inflation.”

The report said on a year-on-year basis, food inflation was highest in Borno at 47.40 per cent, followed by Ebonyi at 30.62 per cent, and Bayelsa at 28.64 per cent.

“Katsina at 6.21 per cent, followed by Adamawa at 10.90 per cent and Sokoto at 15.25 per cent recorded the slowest rise in food inflation on a year-on-year basis.’’

The report, however, said on a month-on-month basis, food inflation was highest in Enugu at 11.90 per cent, followed by Kwara at 9.97 per cent, and Rivers at 9.88 per cent.

“Borno at -7.63 per cent, followed by Sokoto at -6.43 per cent and Bayelsa -6.34 per cent, recorded the slowest rise in inflation on a month-on-month basis.”

The NBS said based on the recent rebasing of the CPI, hence, the CPI rose to 123.4 in June 2025, which reflected a 2.0 point increase from June 2025.

The News Agency of Nigeria (NAN) recalls that the NBS recently rebased the CPI, bringing the base year closer to the current period, from 2009 to 2024, with 2023 as the reference period for expenditure weights.

The Statistician-General of the Federation, Adeyemi Adeniran, said the rebasing was designed to ensure that Nigeria’s economic indicators accurately reflect the current structure of the economy.

According to him, this is done by incorporating new and emerging sectors, updating consumption baskets, and refining data collection methods. (NAN)(www.nannews.ng)

Edited by Ekemini Ladejobi