By Usman Aliyu, News Agency of Nigeria (NAN)

In the sleepy farming village of Ehor, Uhunmwonde Local Government Area of Edo, 47-year-old Mrs Ebun Aikpokpo sits on a wooden bench beside her grocery stall, holding up a small blue POS device.

The machine’s screen flickers weakly before going dark again.

For the third time in the week, she has been unable to complete a customer’s payment due to a failed internet connection.

“I tell my customers to come back later or bring cash; but these days, most of them do not carry cash anymore; some just go elsewhere,” she said with a weary smile.

More so, Mr Francis Ikharo, a 58-year-old widower and cassava farmer at Ayanran village in Akoko-Edo LGA of Edo, clutches his phone and sighs in frustration.

His son had told him that N25,000 was sent to his account under the NG Cares project, but weeks later, he still has not accessed a single naira.

NG Cares is a Federal Government programme, designed to restore the livelihoods of the poor and vulnerable, maintaining food security, and facilitating recovery of Micro, Small and Medium Enterprises (MSMEs) in Nigeria.

“I went to the bank in Igarra and they told me the network was down; I went again two days later, same thing.

“They said even if I had a smartphone and downloaded the mobile banking app, it would not work here; there is no service,” he said.

This is not peculiar to rural communities in Edo; 38-year-old Patience Ogah also experienced failure in internet connection in Karaworo, a quiet village in Adavi Local Government Area of Kogi.

Ogah has run a small convenience store for nearly a decade.

In 2023, she began accepting digital payments after a mobile banking agent set her up with a Point-of-Sale (POS) device.

For a few weeks, business improved; then, reality struck; poor internet connectivity and frequent power cuts made the device nearly unusable.

“Customers get angry when the machine fails. Some think I am trying to cheat them. Others just walk away,” she bemoaned.

Similarly, in Ago Alaye, Odigbo Local Government Area, Ondo State, POS agent Idowu Ajayi has spent the better part of two years running a mobile banking kiosk that services six surrounding communities.

On a good day, he processes up to 40 transactions; on most days, though, he battles poor signal strength and queues of frustrated customers.

“I have bought two different routers; I even climbed a tree to hang my SIM card where the network is stronger; but when the network fails, there is nothing I can do.

“People just curse and leave,” he laments.

These residents noted that the problem was not limited to individual entrepreneurs; local schools and health centres in the areas struggle with integrating digital payment systems for school fees, hospital bills, or government reimbursements.

Rural teachers and primary healthcare workers often cannot receive salaries through mobile transfers because their bank branches are kilometres away, and mobile networks frequently break down.

These experiences reflect a deeper and growing concern in Nigeria’s digital transformation agenda — the rural-urban digital divide that risks leaving millions behind.

Across Nigeria, the use of digital payments has surged, especially in urban areas.

In Lagos, Abuja, Benin City, Lokoja, Akure and other major cities, USSD, QR code payments, fintech apps, and card transactions are part of daily life.

The cashless policy of the Central Bank of Nigeria (CBN) further accelerated this trend, pushing people towards contactless transactions and boosting the mobile money sector.

As Nigeria pursues its National Digital Economy Policy and Strategy (2020–2030) as well as the Nigeria National Development Plan (2021–2025), which together aim to lift 100 million Nigerians out of poverty and expand the digital economy to 25 per cent of GDP by the end of 2025, digital financial inclusion is expected to play a pivotal role.

Interestingly, these digital payment systems are rapidly being adopted in the urban centres, but rural Nigeria, surprisingly, remains disconnected, with low broadband coverage, unreliable electricity, and limited digital literacy undermining access.

Despite the growing digital economy, which contributed an estimated 16 to 18 per cent to the country’s GDP in 2024, millions still remain digitally disconnected.

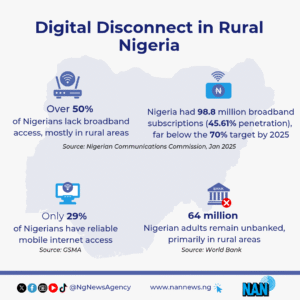

According to the Nigerian Communications Commission (NCC), more than 50 per cent of Nigerians still lack access to broadband, with the vast majority living in rural areas.

According to the NCC, as of January 2025, Nigeria had 98.8 million broadband subscriptions, representing a penetration rate of 45.61 per cent.

While broadband penetration is growing, it is still below the 70 per cent target set for 2025 by the Nigerian National Broadband Plan.

This digital exclusion, financial analysts said, is not just a missed economic opportunity, it is a national development challenge. They claimed as well that the digital economy’s contribution to GDP could even be higher if the rural communities are not left behind.

Globally, Nigeria is considered one of Africa’s top fintech hubs; yet, the Groupe Speciale Mobile Association (GSMA) in its study, reports that only 29 per cent of Nigerians have ‘regular access’ to reliable mobile internet, leaving out 71 per cent due to major infrastructure and regulatory barriers.

The GSMA notes that the full promise of Nigeria’s Strategic Plan 2023–2027 and the National Broadband Alliance for Nigeria (NBAN) would only be realised when the country creates an enabling policy and regulatory framework that actively includes rural areas.

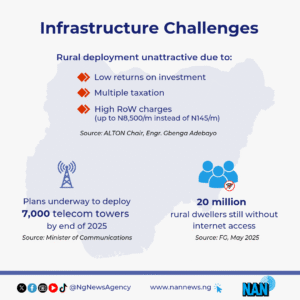

Acknowledging these facts, Dr Bosun Tijani, Minister of Communications, Innovation and Digital Economy, in May, unveiled the Federal Government’s plan to invest in 7,000 towers in these underserved communities.

According to him, the focus is to bridge the digital divide and promote inclusive development in the country.

Under the Renewed Hope Agenda, the minister said that the government had directed his ministry to invest 7,000 towers in giving Nigerians access to telecom networks.

“The 7,000 projects would be delivered by the end of 2025 so that an opportunity can be given to Nigerians regardless of where they find themselves.

“There are about 20 million rural dwellers that still have no access to such facilities.

“The President demanded that money must be put into ensuring that this opportunity is not only available to those in the urban area, but every part of the North.

“This will, in turn, lead to the transformation of the Nigerian economy in all spheres, ranging from health, agriculture and security.”

The minister admitted that the importance of internet connection to Nigeria is profound, touching nearly every aspect of the country’s development.

“Nigeria’s digital economy is one of the fastest-growing in Africa.

“Internet connectivity supports tech startups, e-commerce, fintech, and digital services, contributing significantly to GDP.

‘’Online platforms enable remote work, freelancing, and access to global gig economies. Initiatives like the 3MTT programme aim to create millions of tech-enabled jobs.

“Small and medium enterprises benefit from digital tools for marketing, sales, logistics, and finance,’’ he said.

But Engr. Gbenga Adebayo, Chairman, Association of Licensed Telecom Operators of Nigeria (ALTON), sheds light on why rural deployment remains unattractive to telecom providers, citing hostile policies by the subnational governments.

“Commercial operators face a dilemma. While they are obligated to expand coverage, return on investment is often poor in remote areas compared to urban centres with high demand.

“In addition, operators face hostile sub-national policies, from multiple taxation to outrageous right-of-way (RoW) charges, as high as N8,500 per linear metre, compared to the N145 per metre recommended by the Federal Economic Council,” Adebayo explained.

The ALTON chief added that these hostile conditions discourage investment, especially when some state governments disregard federal policies.

“You’ll hear things like, ‘That’s your Abuja approval; my state has its own rules.’ That inconsistency creates a wall too hard for operators to break through,” he said.

Ultimately, Adebayo said broadband access is not just about connecting villages; it is about connecting people to opportunity.

“Statistics show that a 10 per cent increase in broadband penetration boosts GDP by up to 2.5 per cent; so, when state governments block access, they are not just hurting telcos, they are undermining their own economic future,” said the giant telecom player.

Adebayo believes the solution lies in strategic policy overhaul, unified implementation across all levels of government, and long-term thinking.

“You cannot tax the man building the highway; let them build the digital roads and then tax the users; government needs to recognise the socioeconomic value of infrastructure more than just the immediate Internally Generated Revenue (IGR),” he said.

The stakes of this digital divide are even higher when viewed through the lens of financial inclusion.

In 2024 alone, digital payments in Nigeria hit a record N1.07 quadrillion, according to the Nigeria Inter-Bank Settlement System (NIBSS).

Notwithstanding the feat, a GSMA Mobile Gender Gap Report reveals that nearly 60 per cent of rural Nigerian women do not use mobile internet.

Similarly, the World Bank estimates that 64 million Nigerian adults remain unbanked, mostly in rural areas.

These statistics are not just numbers, they represent real people who are excluded from economic opportunity, government aid, and financial tools that could improve their lives as well as their contribution to economic growth.

For instance, in Ondo State’s Araromi Obu Community, 55-year-old farmer, Baba Adefemi, said he had never used a mobile banking app but depended on his nephew in Akure to help him send or receive money.

When the FADAMA NG Care funds were distributed via digital wallets in 2023, Adefemi received nothing.

“I heard they paid others; but I do not have the phone they use; I do not even know how to use the code they talk about,” he said.

This illustrates the compounding nature of digital exclusion. In many government social programmes, from Conditional Cash Transfers to COVID-19 palliatives and the National Social Investment Programmes, beneficiaries are now required to have National Identification Numbers (NINs) and mobile wallets.

Yet, for millions in underserved communities, these prerequisites remain out of reach.

Nigeria’s digital financial ecosystem is conspicuously expanding, but the enabling infrastructure, particularly in rural areas, is not.

According to a FinTech expert Hussein Olanrewaju, such digital exclusion has layered consequences, ranging from low financial literacy to lack of transactional visibility that prevents rural businesses from accessing credit or growth opportunities.

“There’s virtually no broadband in many rural areas; sometimes you go through hills and trees and cannot even make a phone call, let alone use mobile apps.

“Without power and a consistent network, even voice-based authentication fails,” Olanrewaju, founder of HAQ Technology Management Services, said.

He highlighted the ripple effect of poor infrastructure on trust and user experience such as failed transactions, lack of dispute resolution, and total absence of data trails for rural business activity.

“People still do cash hand-to-hand because they don’t trust the system. There’s no digital record of transactions, no credit profile, nothing to support them when they need loans or grants,” he said.

For Olanrewaju, the government’s failure to address these systemic issues is the core problem.

“The fault is largely on the government in the areas of regulations, power supply, broadband rollout, and even security to protect telecom infrastructure.

“We need tailored interventions, not copy-and-paste policies from other regions,” he said

He also demonstrated how financial literacy constituted the linchpin to economic empowerment.

“People do not realise that sharing your PIN is dangerous or that budgeting matters; even in semi-urban areas, many people live in survival mode, depending on others for financial decisions.

“We must build financial capacity from the ground up,” he submitted.

Both Adebayo and Olanrewaju agree that solving this crisis requires multi-level commitment, beginning with policy harmonisation across federal and state levels, investment in rural broadband infrastructure, and massive financial education campaigns.

They say that the path to Nigeria’s full digital potential is not only through innovation, but inclusion.

Sharing a similar sentiment, Dr Chinenye Okafor, a digital development analyst, argued that Digital Public Infrastructure (DPI), needs to be treated like roads or power lines, which are foundational systems that link citizens to the economy.

“But right now, our DPI rollout prioritises markets, not marginalisation. That’s a structural flaw,” she said regrettably.

The digital development analyst, emphasised that bridging Nigeria’s digital divide requires bold, coordinated, and people-centred reforms.

As solutions to the concerns raised by Adebayo of association of licensed telecom operators, Okafor advocates incentives-backed policy frameworks that will mandate telecom providers to extend broadband access to rural areas. She said these incentives could be subsidies or a universal service fund.

According to her, fintechs and mobile money providers must be compelled to design inclusive platforms, ones that support voice commands, offline functionality, and indigenous languages; so that the digitally excluded, particularly rural women, the elderly, and persons with disabilities, are no longer left behind.

Beyond infrastructure, she underscores the need for systemic digital literacy education across all levels, from schools to community centres, to equip Nigerians with the confidence and skills to thrive in a digital economy.

She further calls for intentional inclusion in Digital Public Infrastructure (DPI) initiatives and deeper public-private partnerships to establish community-based digital service hubs.

“Digital inclusion must be treated as a public utility, not a privilege,” she asserts, noting that Nigeria could not build an inclusive economy on a broken digital foundation.

Stemming from the foregoing, it is established that Nigeria stands at a crossroads.

Its digital economy has the potential to leapfrog traditional barriers, empower citizens, and transform governance; but unless digital public infrastructure is extended equitably and not just profitably, the country risks reinforcing the same divisions it hopes to erase.

As this story reveals, experts see the problem of digital financial exclusion as not just technological, but also political, cultural, and deeply human.

Bridging the divide will require more than bandwidth; rather, it demands political will, inclusive design, and a firm commitment to leaving no one behind.

Until that happens, observers say rural Nigerians like Aikpokpo, Ikharo, Ogah, Ajayi and Adefemi will continue to be disconnected, and left behind; not because they do not want to join the digital future, but because the system has not shown up at their doorstep. (NANFeature)

This report is produced with support from Centre for Communication and Social Impact (CCSI)