By Nana Musa

The Federal Government has reaffirmed its commitment to accelerating private sector participation in infrastructure development.

The News Agency of Nigeria (NAN) reports that to this end, it has unveiled a series of reforms and strategic initiatives aimed at closing Nigeria’s multi-trillion-dollar infrastructure gap.

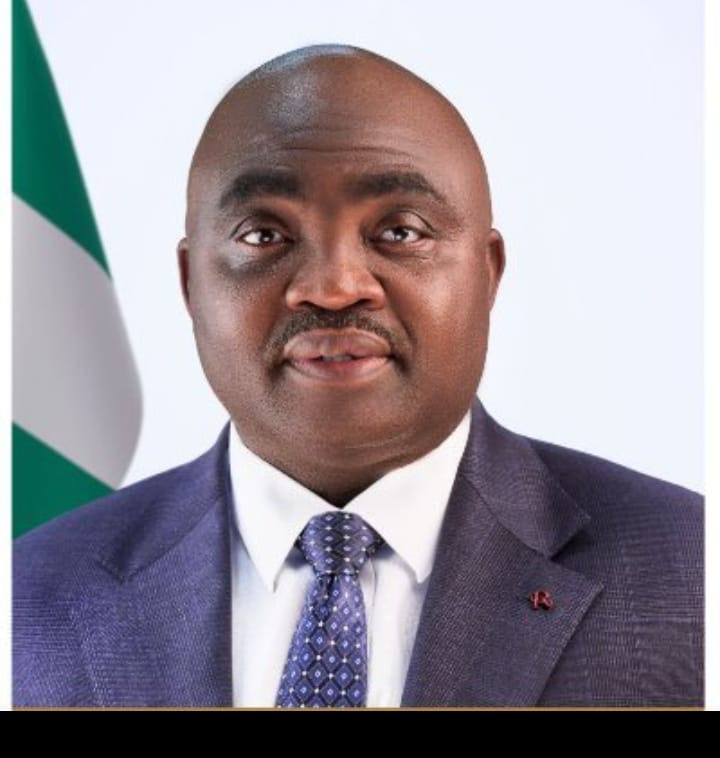

The Director-General of the Infrastructure Concession Regulatory Commission (ICRC), Dr Jobson Ewalefoh, said this at the Chief Executives Officers (CEOs) Roundtable, with the theme “The Future of Infrastructure Funding” in Abuja on Tuesday.

He said that the infrastructure deficit estimated at more than three trillion dollars over the next 30 years, which presents a daunting challenge and a historic opportunity for economic transformation.

“The conversation before us is not merely about financing physical assets, it is about financing the future of national productivity, regional integration, and inclusive growth.”

Ewalefoh said that public resources alone could no longer fund the scale of investment required, adding that the future of Nigeria’s infrastructure must rest on innovative, private sector-led, and de-risked financing models that mobilised long-term capital and deliver sustainable value.

According to him, the ICRC is taking decisive steps to strengthen the Public-Private Partnership (PPP) framework through a new strategic direction anchored on six key pillars.

He said that the six pillars were time bound project delivery, inter-agency collaboration, service delivery optimisation, strategic partnerships, project categorisation, and innovative financing.

‘These pillars reflected the commission’s commitment to regulatory stability, efficiency, and collaboration, ensuring that Nigeria’s infrastructure ambitions were transformed into bankable, deliverable outcomes that drive sustainable development,” Ewalefoh said.

He commended President Bola Tinubu’s recent policy reforms, notably the project approval thresholds, empowering MDAs to independently approve PPP projects below N20 billion, subject only to obtaining ICRC’s compliance certificate as a key prerequisite.

“This reform is not just an administrative adjustment, it is a strategic signal of trust and partnership.

“It will enable faster decision-making, decentralised implementation, and greater responsiveness to investor timelines,” he said.

Ewalefoh said that sustainable infrastructure funding would depend not only on capital availability but also on institutional credibility, policy coherence, and disciplined implementation.

He urged closer collaboration among government agencies, private investors, and development partners to create a flexible and inclusive financing ecosystem, that connects domestic pension and insurance funds to viable infrastructure assets through innovative risk-mitigation tools.

The director-general also acknowledged the critical role of development finance institutions and multilateral agencies such as the African Development Bank (AFDB) in catalysing investment through blended finance and guarantees.

“The task before us is unmistakably clear to translate our infrastructure aspirations into tangible, financeable, and deliverable outcomes that strengthen investor confidence and secure a resilient, prosperous future for our nation,” he said. (NAN)(www.nannews.ng)

Edited by Ese Erica William