Okeoghene Akubuike

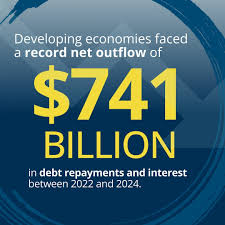

The World Bank says developing countries paid 741billion dollars more in principal and interest on their external debt than they received in new financing between 2022 and 2024.

A statement issued by the World Bank Online Media Briefing Centre on the latest International Debt Report on Wednesday, said that the debt outflows marked the largest gap in at least 50 years.

It said that in spite of the heavy outflows, most countries enjoyed some relief in 2024 as interest rates peaked and international bond markets opened up again.

“This enabled many countries to stave off the risk of default through debt restructuring, with developing countries collectively restructuring 90billion dollars in external debt, the highest level since 2010.”

The report said that bond investors provided significant support, injecting 80billion dollars more in new financing than they received in repayments and interest, helping several complete multi-billion-dollar bond issuances.

It, however, said that the funds came at a high price, with interest rates averaging around 10 per cent, about double the pre-2020 levels.

Indermit Gill, World Bank Group Chief Economist and Senior Vice-President for Development Economics, was quoted as saying that global financial conditions might be improving, but developing countries are not out of danger.

“Their debt build-up is continuing, sometimes in new and pernicious ways.

“Policymakers everywhere should make the most of the breathing room that exists today to put their fiscal houses in order instead of rushing back into external debt markets.”

The report said that the external debt of low- and middle-income countries rose to a historic 8.9 trillion dollars in 2024.

It said that 78 mainly low-income countries eligible to borrow from the World Bank’s International Development Association (IDA), owed a record 1.2 trillion dollars.

The report said that the average interest rates that developing economies would pay their official creditors on newly contracted public debt in 2024 stood at a 24-year high and a 17-year high from private creditors.

“These nations spent a record 415billion dollars on interest payments alone; funds that could have gone into education, healthcare and essential infrastructure.”

The report highlighted the human cost of rising debt burdens.

“It said that in the most heavily indebted countries, one out of every two people could not afford the minimum daily diet required for long-term health.

It said that access to low-cost financing became harder in 2024, except from multilateral development banks like the World Bank, which was the single-largest financier of IDA-eligible countries.

The report said that the bank provided 18.3billion dollars more in new financing to IDA-eligible countries than it received in principal and interest payments and also disbursed a record 7.5billion in grants.

“Official bilateral creditors, mostly governments and government-related entities, retreated after participating in a wave of restructurings that cut long-term external debt of some countries by as much as up to 70 per cent.”

It said that in 2024, bilateral creditors received 8.8 billion dollars more in principal and interest than they disbursed in new financing for developing countries.

The report said that with low cost financing options dwindling, many developing countries turned inwards to local commercial banks and financial institutions.

It said that of the 86 countries with domestic data available, more than half recorded faster growth in domestic government debt than external government.

Haishan Fu, World Bank Group Chief Statistician and Director, Development Data Group, said that the rising tendency of many developing countries to tap domestic sources for their financing needs reflects an important policy accomplishment.

“It shows that their local capital markets are evolving. But heavy domestic borrowing can spur domestic banks to load up on government bonds when they should be lending to the private sector.

“Domestic debt also comes with shorter maturities, which can raise the cost of refinancing. Governments should be careful not to overdo it.”

The report further revealed that heavily indebted countries with external debt exceeding 200 per cent of export revenue, an average of 56 per cent of the population could not afford a minimum daily diet.

It said that 18 of the countries were IDA-eligible, where nearly two-thirds of the population could not afford the necessary diet. (NAN)(www.nannews.ng)

Edited by Kadiri Abdulrahman