Forbearance

By Ginika Okoye

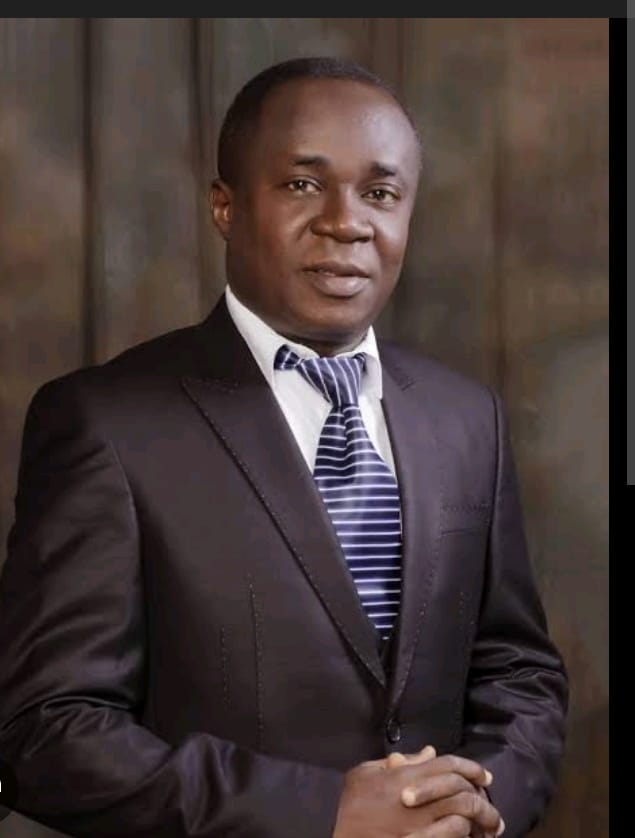

A financial expert, Prof. Uche Uwaleke, says granting limited regulatory forbearance to capital market entities making demonstrable efforts towards achieving the Minimum Capital Requirement (MCR) will improve outcomes.

Uwaleke, who is the President, Capital Market Academics of Nigeria (CMAN), was reacting to the new revised MCR for capital market entities released by the Securities and Exchange Commission (SEC) on Jan. 16.

In an interview with the News Agency of Nigeria (NAN) on Saturday, Uwaleke said that SEC needed to fast-track approvals for mergers, acquisitions and strategic investments to also improve outcomes.

On the timeline for the MCR, he said that the June 30, 2027 deadline, which is 18 months from January 2026, was defensible by international standards.

Uwaleke however, said that the timeline was undeniably demanding in the country’s context.

“Globally, regulatory-driven recapitalisation of Capital Market intermediaries typically allows between 12 and 24 months.

“The EU and UK investment-firm prudential reforms provided about 18-24 months.

“In India and South Africa, stockbrokers and other market intermediaries are given roughly 12 to 24 months depending on size and activity.

“Seen against this backdrop, the SEC’s timeline is not out of line with global practice,” he said.

According to him, adequacy of timelines depend less on the headline date and more on local market realities.

“It is a fact that many Capital Market operators in Nigeria are privately owned, thinly capitalised, and operate in an environment of high interest rates and limited access to long-term capital.

“For such firms, 18 months must accommodate valuation, due diligence, regulatory approvals, and actual capital raising,” Uwaleke said.

The Professor of Capital Market said that SEC needed to complement the deadline with thoughtful implementation to ensure success.

According to him, clear and early guidance on compliance modalities is crucial,

NAN recalls that SEC had on Jan. 16, released a circular raising the MCR for regulated market entities in the country.

The commission said that the review was informed by the need to strengthen market resilience, enhance investor protection, and align capital adequacy with the evolving risk profile of market activity.

It said that the move was also to ensure that regulated entities possessed sufficient financial capacity to discharge their obligations in a sustainable manner.

According to circular on its website, SEC said that the minimum capital would enhance the financial soundness and operational resilience of market operators.

“The objective of the minimum capital framework is to align capital requirements with the scope, complexity, and risk exposure of regulated activities,” it said.

It raised the MCR of Issuing House (non-interest finance services) from N200 million to two billion while Issuing House with underwriting services was increased from N200 million to seven billion naira.

SEC said that all entities were required to comply with the revised Minimum Capital Requirements on or before June 30, 2027.

It said that all entities that failed to meet the prescribed requirements within the stipulated timeline would be subjected to appropriate regulatory sanctions, including suspension or withdrawal of registration.

NAN reports that the MCR for registrars was also reviewed from N150 million to N2.5 billion, among others. (NAN)(www.nannews.ng)

Edited by Benson Ezugwu/Kadiri Abdulrahman