By Emmanuel Oloniruha

The Abuja School of Social and Political Thought (TAS), an NGO, has advised the Federal Government to view taxation not merely as a revenue generation tool, but as a “social contract” essential for inclusive economic growth and public accountability.

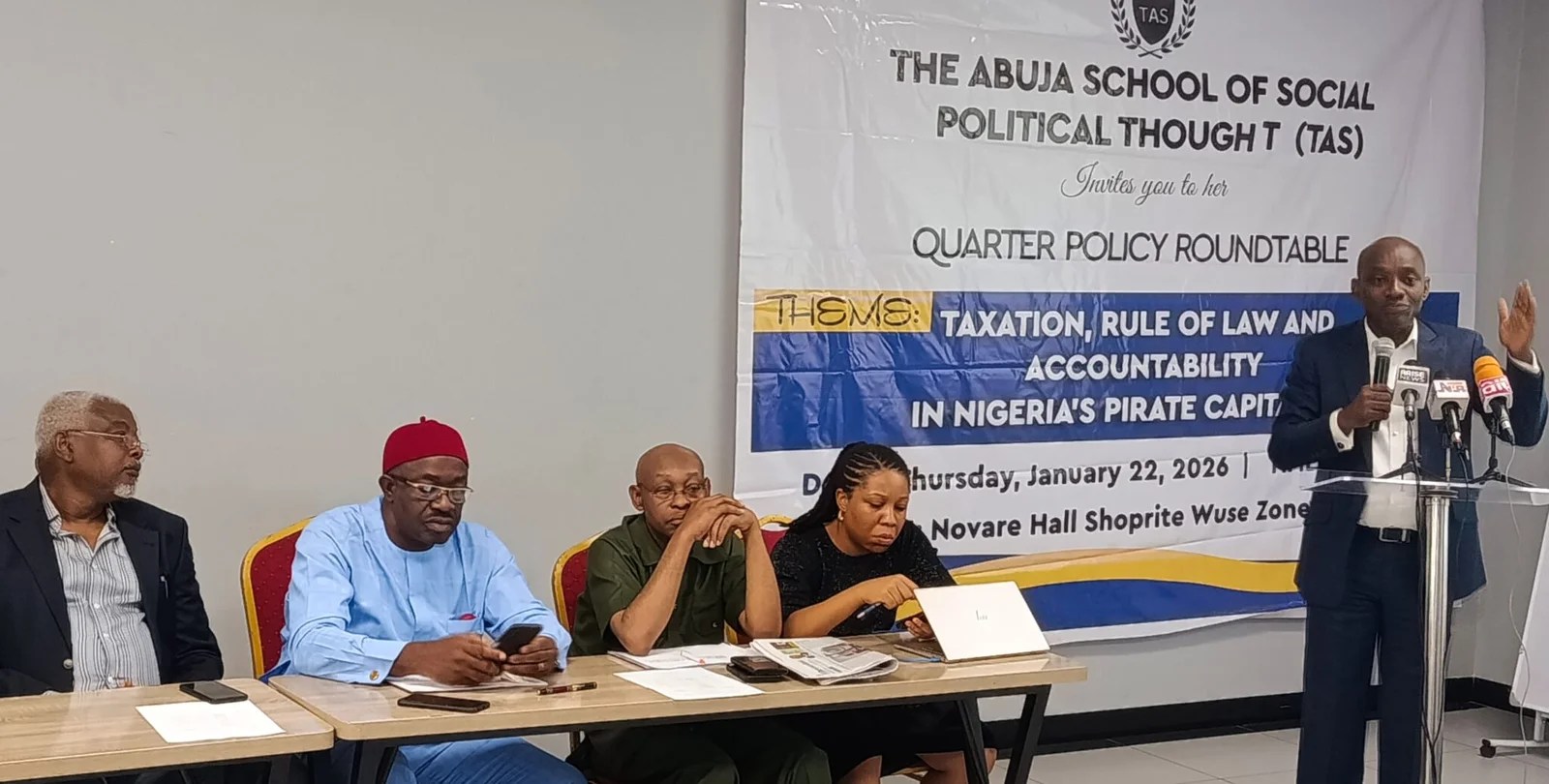

The Director of TAS, Dr Samuel Amadi, made the call in Abuja at the school’s quarterly policy roundtable with the theme, “Taxation, Rule of Law, and Accountability in Nigeria’s Private Capitalism”.

Delivering his presentation, “Critical Perspectives on New Tax Regime: From Public Finance to Constitutional Governance and Social Justice,” Amadi called for a paradigm shift in Nigeria’s tax reform.

He said that issues surrounding public finance “go beyond finance and economics and center around constitutional governance and questions of justice.”

While lauding the government’s efforts to streamline the tax system, Amadi stressed that reforms must be anchored on constitutional due process.

He noted that while a more coherent tax administration was commendable, its ultimate success lies in its ability to protect the vulnerable and stimulate the economy.

“The idea of tax reform is good; it creates clarity and coherence. However, we must move beyond ‘fiscal mobilisation’ to ‘fiscal social justice.’

“It is about how these funds are used to reduce poverty and improve the consumer power of the average Nigerian,” Amadi said.

He noted that Adam Smith in the `Wealth of Nation’ argues that there are key principles that should define good tax policy, namely Fairness- equity, Certainty, Convenience, and Efficiency.

Amadi said that a good taxation policy also performed five main functions in an economy that is fiscal (revenue generation), redistribution of wealth, regulate consumption, control certain goods and services, and promoting local production.

For proposed the tax reforms to translate into tangible benefits for the citizenry, Amadi recommended the establishment of a visible social compact.

He advised government to adopt models where taxpayers receive detailed notices specifying how their contributions were spent on public services like healthcare and infrastructure.

Amadi urged that no tax policy should be enforced unless it is strictly stipulated by a properly passed law, ensuring that “constitutional economics” guides every fiscal decision.

Calling for tax policies to go hand-in-hand with increased social spending, Amadi argued that citizens were more likely to comply with taxes when they see a direct link to improved public welfare.

Highlighting data that shows a vast majority of Nigerians earn below N100,000 monthly, Amadi recommended maintaining high tax-exempt thresholds to prevent the system from becoming “extractive” toward the poor.

He also noted that the transition from the Federal Inland Revenue Service (FIRS) to a more integrated revenue structure must be supported by judicial processes that protect citizens’ rights.

Also, Dr Friday Ohuche, a Development Economist and International Economic Governance Expert, described taxation acts as a vital fiscal policy instrument for economic growth.

Ohuche, however, expressed concern over the high tax-exempt thresholds and the treatment of the informal sector, which constitutes approximately 60 per cent of the current economy.

In his presentation “ Nigeria new tax regime: Implications for economic growth and equity, “Ohuche warned against “regressive” tax functions that could stifle local production.

He highlighted challenges facing the new tax regime to include fiscal Neutrality, the informal sector trap, saying a lack of data leads to aggressive or “extractive” taxing of informal workers who lack social protections.

He also identified constitutional crisis, noting the potential for conflict between local, state, and federal governments over revenue collection rights.

Ohuche, emphasised the need for visible social compact that provide taxpayers with direct evidence of tax-funded projects.

He also recommended high tax-exempt thresholds that protect citizens earning below N100,000 monthly from “extractive” taxation.

He also recommended extending tax-exempt status for educational startups and research-driven ventures to foster innovation within university hubs.

Ohuche advised government to maintain zero per cent Value Added Tax on all educational materials, including digital tools and textbooks, to keep the cost of learning low.

To prevent misinformation, he urged the government to partner with academic institutions to lead a nationwide “Tax Literacy” campaign, explaining the shift from the FIRS to the newly formed Nigeria Revenue Service (NRS).

He also emphasised the need for judicial oversight to ensure the transition to integrated revenue structures is supported by processes that protect citizens’ rights

Ohuche also recommended institutional transparency that simplify the enforcement institutions to eliminate “double taxation” and corruption. (NAN)(www.nannews.ng)

Edited by Olawunmi Ashafa

====