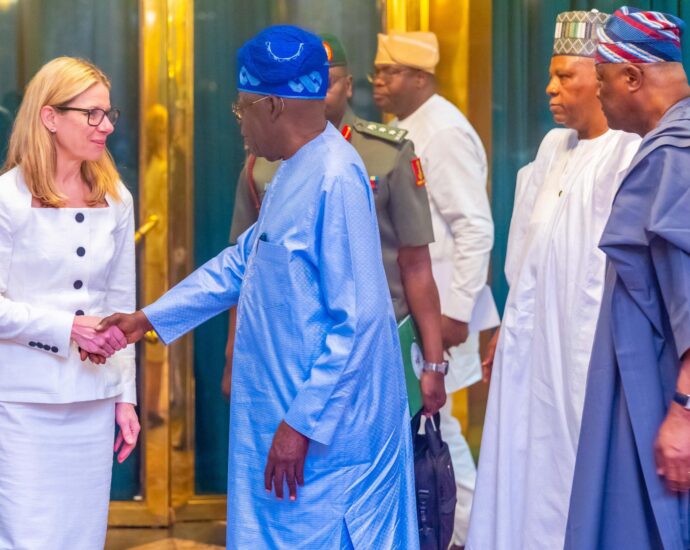

Centre urges Tinubu to unlock dormant industrial assets

By Mustapha Yauri A leading policy think tank, the Galadiman Ruwa Centre for Strategic Leadership and Communication (GCSLC), has urged President Bola Tinubu to unlock Nigeria’s underutilised sovereign industrial assets. The Centre said the move would provide a viable pathway to sustainable economic growth and long-term national prosperity. Dr Ja’afaruContinue Reading