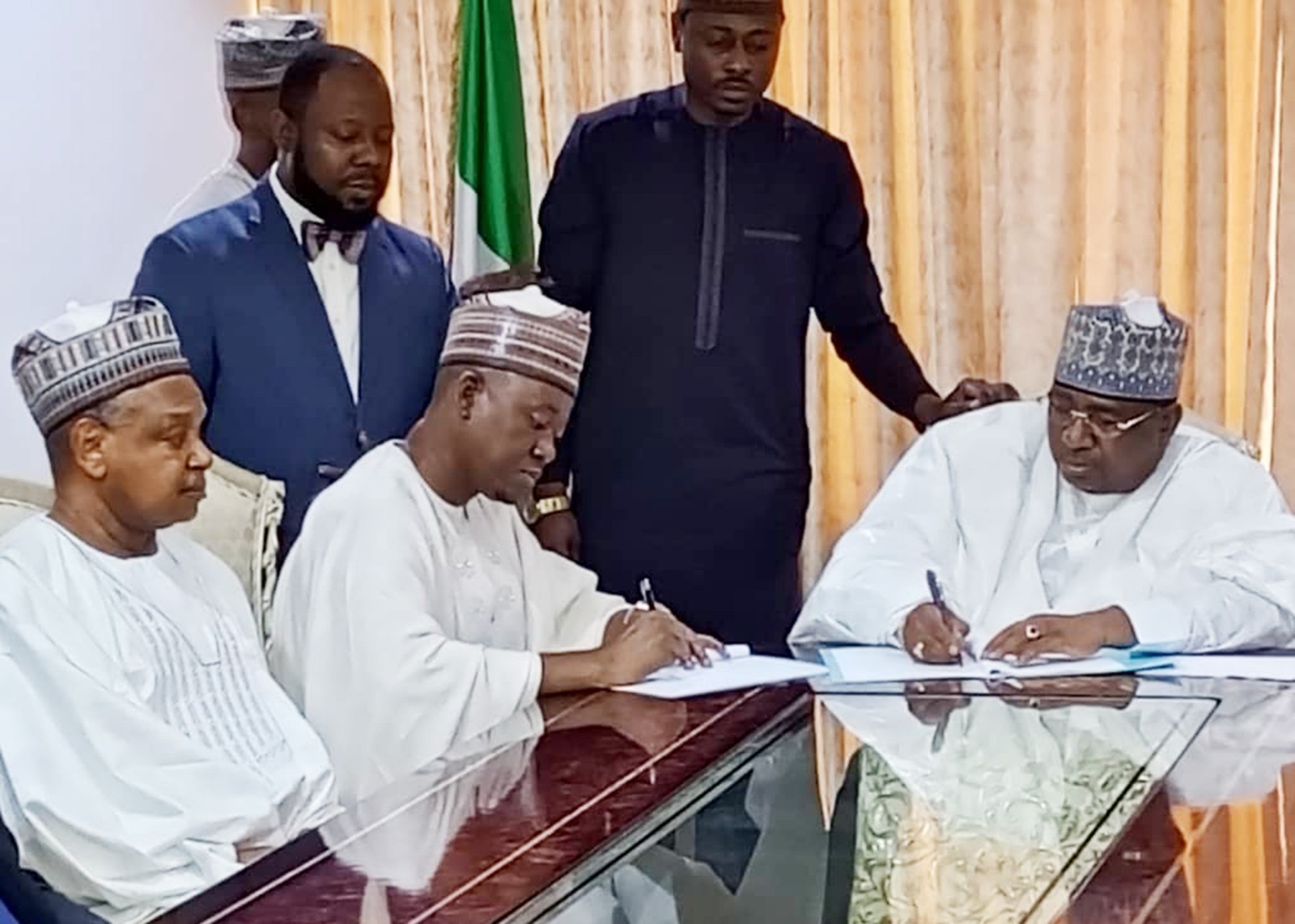

Dangote returns to Ogun, plans largest port

By Abiodun Lawal The President of Dangote Group, Alhaji Aliko Dangote, says his company returned to invest in Ogun due to Gov. Dapo Abiodun’s investor-friendly policies. Dangote made this known during a courtesy visit to the governor at his office in Abeokuta. He noted that the state had become oneContinue Reading