No shortfall in workers’ salaries, OAGF insists

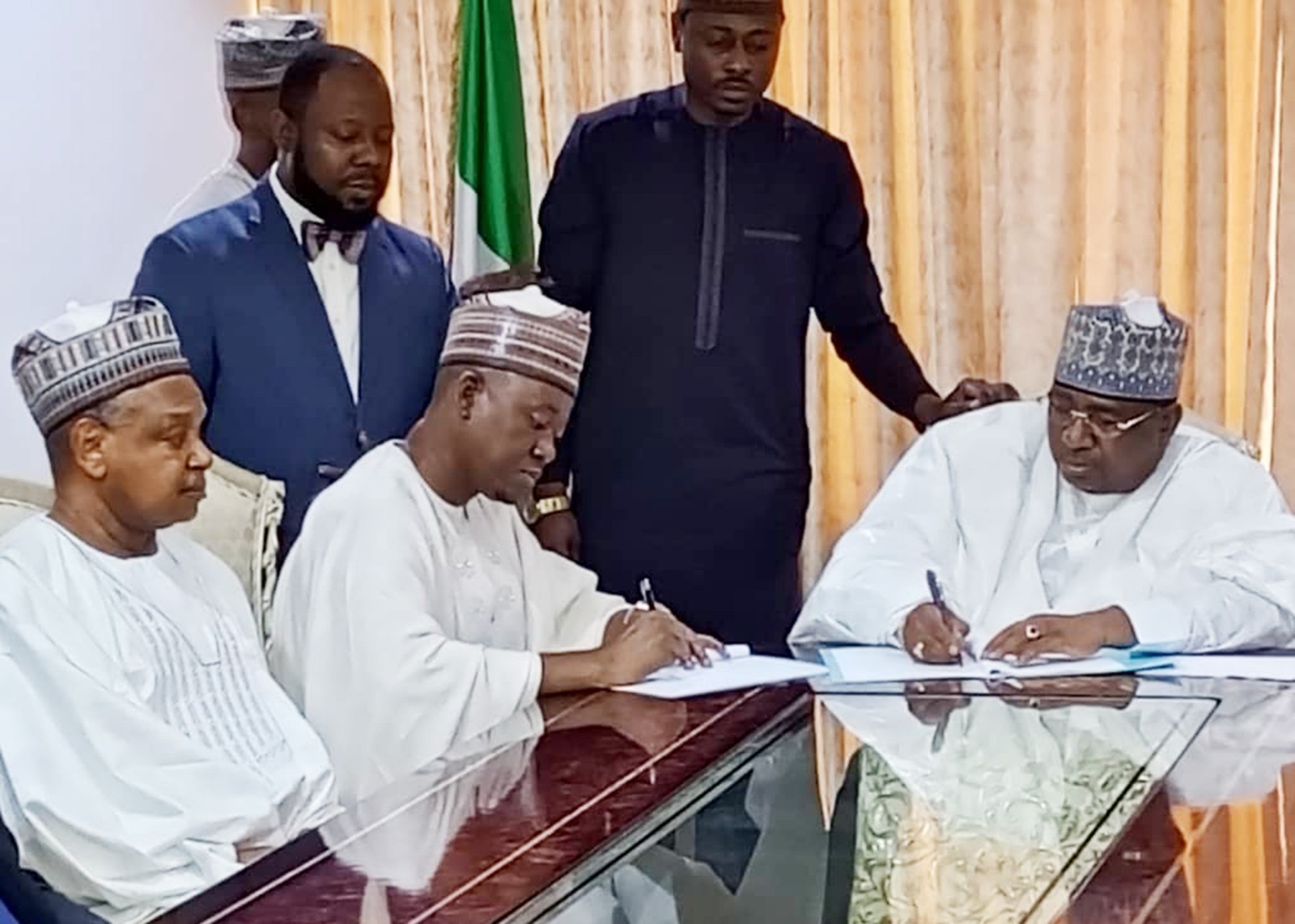

Salaries By Kadiri Abdulrahman The Office of the Accountant-General of the Federation (OAGF),has clarified that there are no shortfalls in salaries paid to federal workers in January and February. The OAGF made the clarification in a statement issued by Bawa Mokwa, the Director, Press and Public Relations in Abuja. MokwaContinue Reading