Lokpobiri attributes hike in petrol price to deregulation

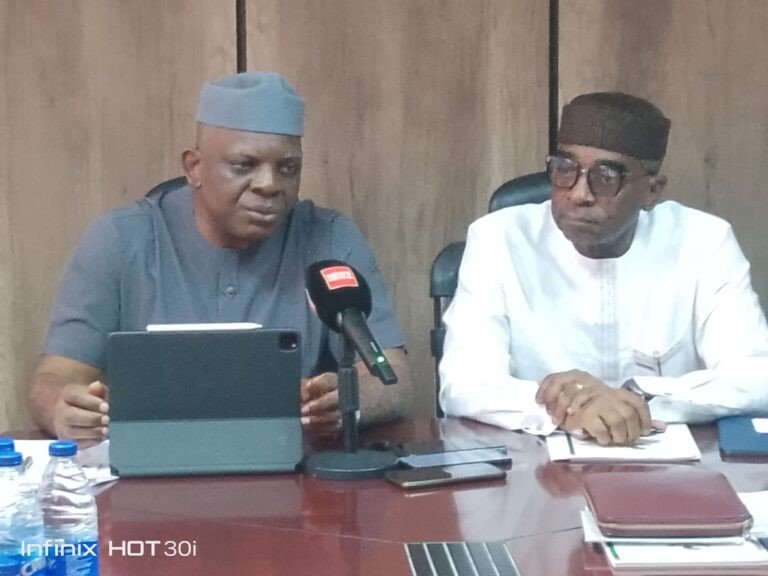

By Salif Atojoko Sen. Heineken Lokpobiri, Minister of State (Oil) Petroleum Resources, on Thursday, said the Federal Government was not responsible for the recent increase in the price of petrol across the country. The minister said this while briefing State House correspondents after a meeting with Vice-President Kashim Shettima. LokpobiriContinue Reading