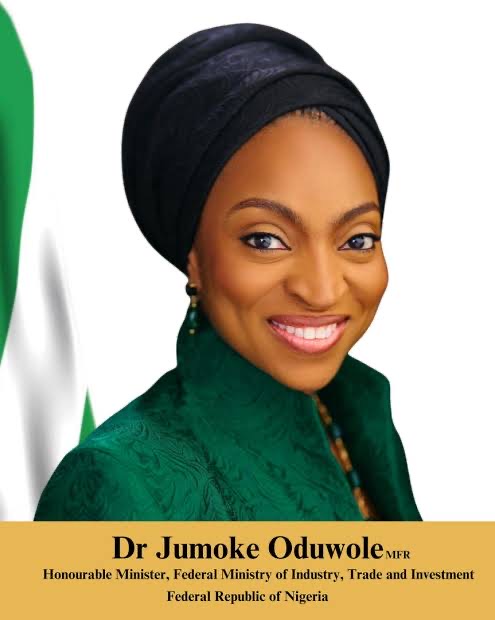

FG to achieve $1trn economy by 2030 – Minister

By Vivian Emoni The Federal Government has demonstrated its commitment toward achieving one trillion dollars economy by 2030 through domestic investment summit to actualise its 8-point Renewed Hope Agenda. Dr Jumoke Oduwole, Minister of Industry, Trade and Investment, said this at a Domestic Investment Summit, in Abuja on Monday. TheContinue Reading