Nigeria committed to national sugar master plan objectives – FG

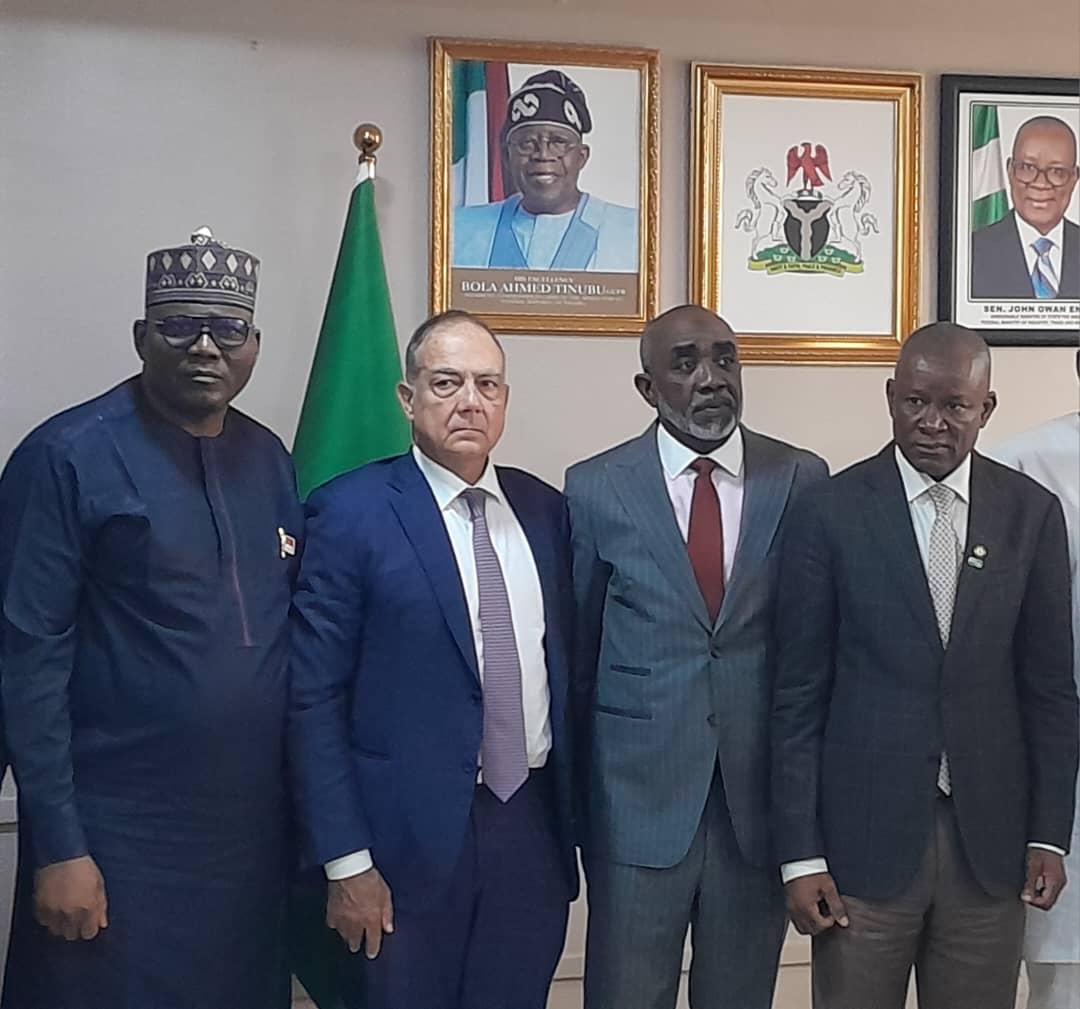

By Lucy Ogalue The Minister of State for Industry, Sen. John Enoh, says Nigeria’s sugar industry must meet its domestic production target in line with the objectives of the National Sugar Master Plan (NSMP). Enoh made this known during a high-level stakeholders’ meeting on Wednesday in Abuja. The National SugarContinue Reading