Wike to unveil 54 heavy-duty machines to strengthen Edo infrastructure development

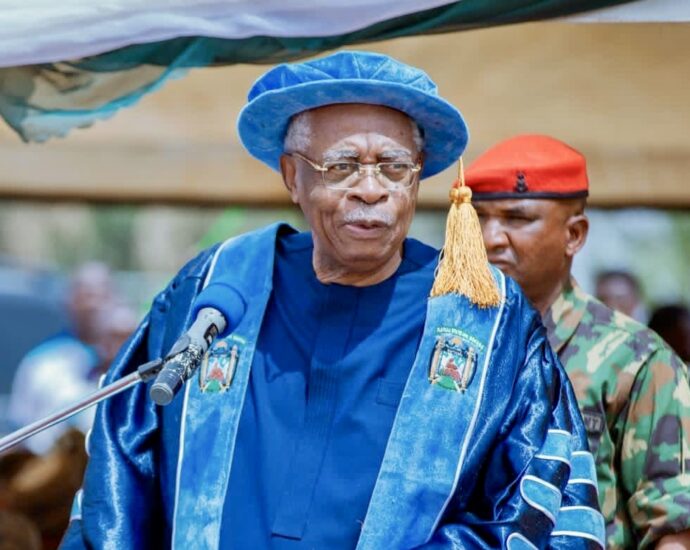

By Oladapo Udom Minister of the Federal Capital Territory, Nyesom Wike, will on Thursday inaugurate 54 units of construction equipment to strengthen infrastructural development across the 18 local government areas of Edo. Dr Patrick Ebojele, Chief Press Secretary to Gov. Monday Okpebholo of Edo, stated this in a pressContinue Reading