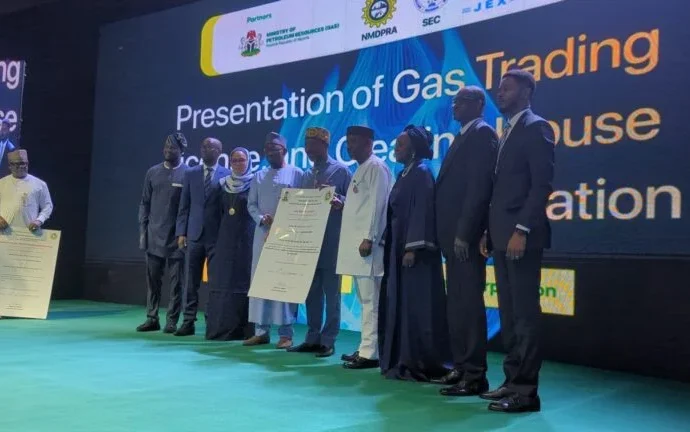

Firm targets electric vehicles investment as next phase of energy transition

Mr Quadri Fatai, Group Managing Director/Chief Executive Officer of Alfa Designs Nigeria Ltd., says the company plans to invest in electric vehicles (EVs) as a long-term component of Nigeria’s energy transition.Continue Reading