Bar retired civil servants for 1 year from contesting elections- Ndarani

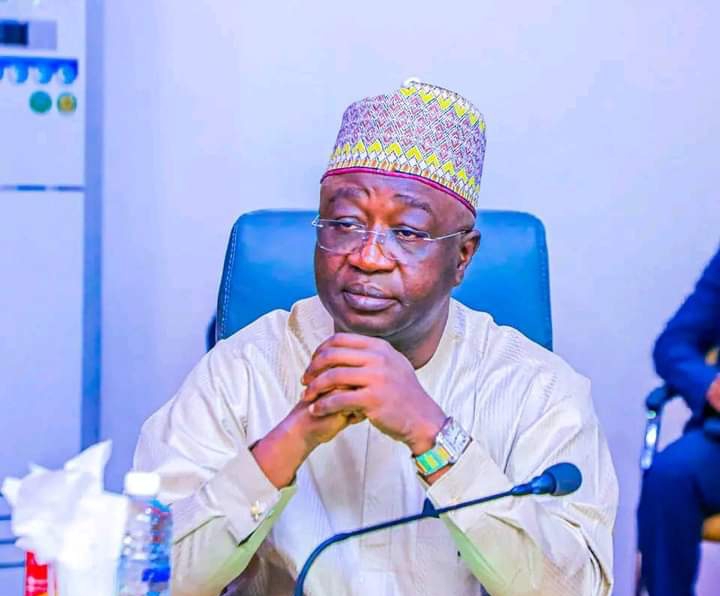

By Ebere Agozie/Perpetua Onuegbu A Senior Advocate of Nigeria, SAN, Mohammed Ndarani, on Wednesday, urged the Federal Government to bar retired civil servants from contesting for any elective position for at least one year after their retirement. Ndarani, who made the call at a news conference in Abuja , saidContinue Reading