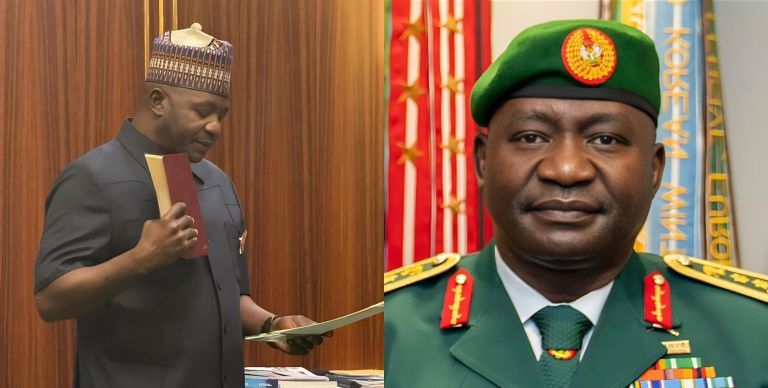

Security expert lauds Tinubu’s choice of Musa as defence minister

By Sumaila Ogbaje A security and intelligence expert, Dr John Metchie, has lauded President Bola Tinubu’s choice of Gen. Christopher Musa as the new Defence Minister. Metchie gave the commendation when he briefed newsmen on Friday in Abuja. The security expert said the appointment marked a watershed in the protectionContinue Reading