FIRS directs opening of tax offices on weekends

By Kadiri Abdulrahman

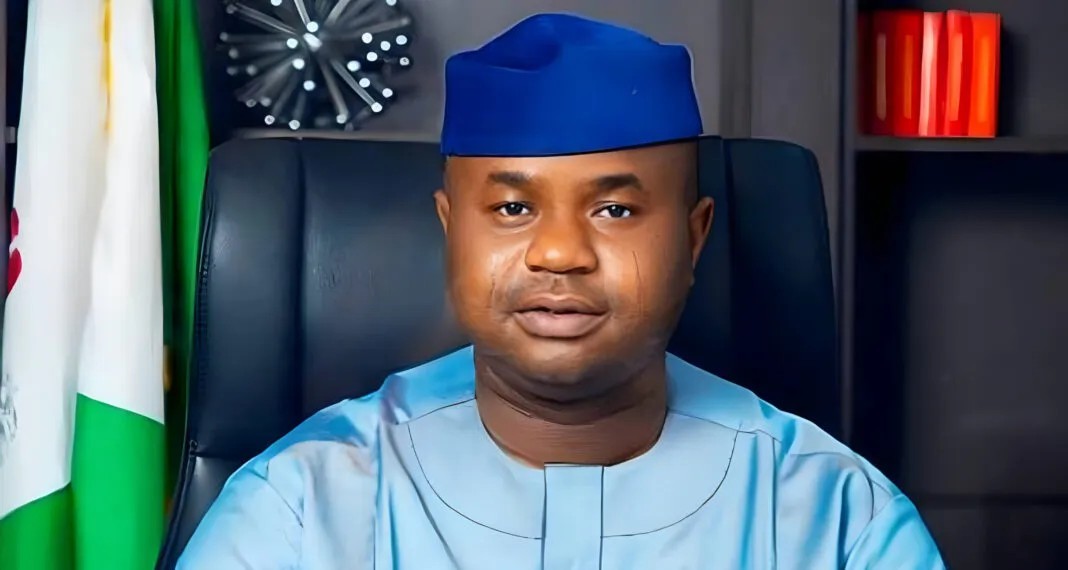

The Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, has directed the extension of tax office operations to weekends for the month of June.

Adedeji gave the directive in a statement issued by Dare Adekanmbi, the Special Adviser on Media to the FIRS chairman.

According to Adekambi, it is part of Adedeji’s commitment to matching the agency’s customer-centric policy with tangible action.

“With the directive, tax offices are expected to open for business from 10:00 a.m. to 4:00 p.m. on Saturdays and 12:00 p.m. to 4:00 p.m. on Sundays throughout the month of June,” he said.

“The weekend service, which started on June 14, will end on Sunday, June 29.

“It is aimed at helping companies that are mandated by law to file their tax returns by the end of the month meet up with the deadline,” he said.

He said that the coordinating directors of Large Taxpayers Group, Government and Medium Taxpayers Group, as well as Emerging Taxpayers Group had conveyed the decision of the management to all staff in the tax offices.

“As you are aware, the month of June marks the peak of the annual Companies Income Tax (CIT) filling season.

“Many taxpayers which financial year ends December 31, are expected to file their tax returns by June 30.

The News Agency of Nigeria (NAN) recalls that the FIRS chairman on assumption of office, reorganised tax operations for ease of tax payment.

This has led the transformation of the agency from merely being a tax-collecting entity to a service-providing body. (NAN)(www.nannwws.ng)

Edited by Ese E. Eniola Williams