FG to reduce inflation, create more jobs- Edun

By Nana Musa

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, says the Federal Government plans to reduce inflation rate to single digit and create more jobs.

Edun stated this during a press conference addressed by the Nigerian economic team, as part of activities marking the end of the 2025 the International Monetary Fund (IMF) and World Bank Spring Meetings on Saturday in Washington D.C.

He said that the government was collaborating with development partners like the World Bank to create jobs for Nigerians in pursuit of sustainable employment and poverty eradication.

“The objective is to create jobs locally, empower youths, and support them through essential infrastructure.

“That includes digital infrastructure, access to data, internet, and fibre optic networks, to enable them to work remotely,” the minister said.

Edun said that the country’s unemployment rate had dropped to 4.3 per cent in the second quarter of 2024 from 5.3 per cent in first quarter 2024.

According to him, the world now faces a very uncertain future, but Nigeria is well positioned to survive the shocks in spite of heightened tensions, inflation, and declining global growth.

The minister also said that President Bola Tinubu’s reform agenda were working and the results were commendable.

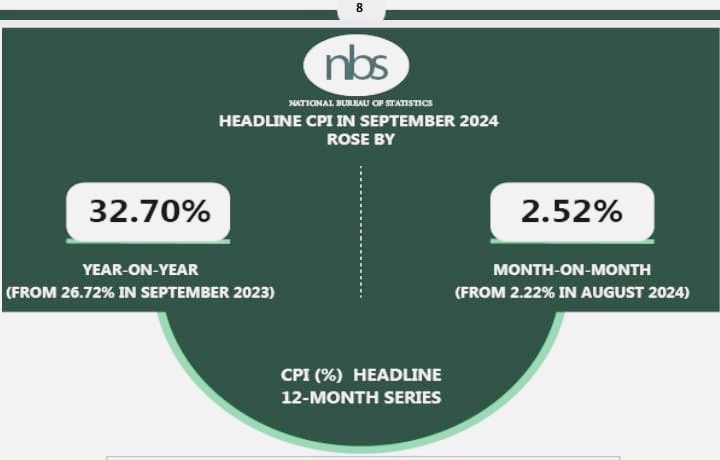

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, said that the government acknowledged the impact of inflationary pressures on the country.

“We recognise that inflation remains the most disruptive force to the economic welfare of Nigerians.

“Our policy stance is firmly focused on bringing inflation down to single digits in a sustainable manner over the medium term,” Cardoso said.

The CBN governor said that the painful reforms embarked upon by the country was now yielding positive results.

“At the IMF meetings the nation was a reference point of how reforms could change the economic trajectory of a nation for the better.

“The reforms are not easy, but they are delivering results. We have moved from a position of vulnerability towards one of growing strength,” he said.

Cardoso said that the significance of Nigeria’s efforts was restoring investors confidence.

“The country had a high-level investment forum at the Nasdaq Market Site in New York.

“That gave insights into the positive impact of the reforms and growing appetite for investment in Nigeria by Diaspora Nigerians and non-Nigerians.

“The New York forum delivered powerful outcomes, it significantly bolstered investor confidence in the country’s market fundamentals, with leading voices affirming the country’s economic progress and renewed standing as a compelling investment destination,” he said.

The CBN governor said that the country recorded a balance of payments surplus of 6.83 billion dollars in 2024, principally on the back of rising exports and capital inflows.

According to him, this has supported the stability of the domestic unit amidst boosted investor confidence, discouraged speculative arbitrage and closed the gap between official and parallel market rates.

Cardoso said that the recapitalisation efforts were gaining momentum with maximum support and compliance from all stakeholders in the banking sector.

He said that the Tinubu-led government planed to set the nation on an ambitious trajectory of becoming a one trillion dollar economy by 2030.

According to him, the CBN has set the capital base for financial lenders nationwide, highlighting its goal of enhancing banks’ ability to fund large-scale projects and drive economic activities.

“The banking sector recapitalisation is well underway, with strong momentum and stakeholder alignment,” Cardoso said.

The Chairman of the Senate Committee on Finance, Sen. Sani Musa, said that the country was doing well to reposition the financial system so as to restore confidence.

“The economic team of this administration is doing very well on the fiscal aspect of our economy, so that poverty will be reduced.

“I think we have done all the needful in terms of activities to the tax reform bills to make them workable,” he said.

The News Agency of Nigeria (NAN) recalls that the delegation, which was led by Edun, include Cardoso, Director-General of the Debt Management Office, Patience Oniha, and other top government officials.

NAN reports that the delegation had a series of meetings with fund managers, global financial leaders, and multilateral institutions investors.

Also, meetings were held with other development partners to cement existing relationships, create new partnerships and spread the news of the dividends of Nigeria’s economic reforms.(NAN)(www.nannews.ng)

Edited by Ismail Abdulaziz